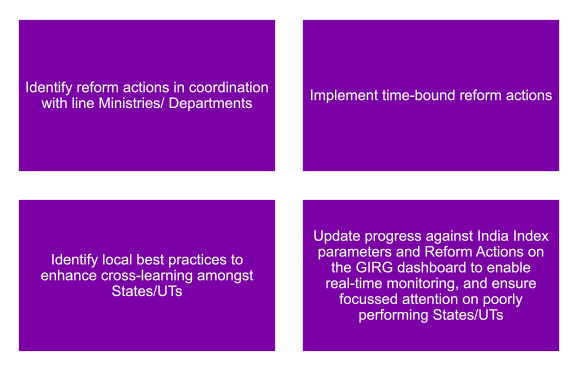

The exercise on monitoring select Global Indices to drive Reforms and Growth (GIRG) envisages that the most important role in this far-reaching, over-arching initiative be played by States/UTs, with support from line Ministries/ Departments at the Centre. Central Line Ministries/ Departments are in process of identifying reform areas in consultation with all stakeholders. The inputs expected from State/ UTs towards improving citizen service delivery, enhancing quality of life and ease of doing business include the following:

The aim of the exercise is to boost cooperative and competitive federalism. All nodal Ministries/ Departments for all identified Global Indices are in process of preparing Reform Action Plans, on lines of the Business Reform Action Plan (BRAP) prepared by the Department for Promotion of Industry and Internal Trade (DPIIT) for the Ease of Doing Business Index.

The Reform Actions would highlight the broad actions to be undertaken; States/UTs may decide the exact path and process to be followed for their respective reforms. An example of a Reform Action from BRAP 2020-21 and related activities is given below.

| Reform Area: Paying Taxes | Objectives |

|---|---|

| Reform Action 1: Set up service centres to assist taxpayers for e-filing of returns under the State/Union Territory GST Act Reform Action 2: Establish a helpline providing basic services such as assisting users in preparing and filing returns under the State/Union Territory GST Act Reform Action 3: Constitute an authority for advance ruling under the State Goods Service Tax and publish details of application procedure and checklist on the Department's website Reform Action 4: Constitute an appellate authority for advance ruling under the State Goods Service Tax and publish details of application procedure and checklist on the Department's website |

|

Act reference: Chapter XVII on ‘Advance Ruling’ of State/UT GST Act.

GOVERNMENT OF INDIA

GOVERNMENT OF INDIA